Non collective deductible 244260-Collective vs non collective deductible

Under the nonembedded deductible, all family members qualify for the plan benefit if the total annual family deductible amount is met by one or any combination of covered individuals If you have $2,000 in covered medical expenses for the year, and one child has $1,000, the annual family deductible is met for everyone covered under the policy, and all are eligibleIt depends on the Fiscal Host of the Collective If the host has taxexempt status, then your donation can be tax deductible It also may matter which country the host is in The Open Source Collective 501(c)(6) is a nonprofit that serves as fiscal host to most open source software projects on Open CollectiveIf you meet your annual deductible in June, and need an MRI in July, it is covered by coinsurance If the covered charges for an MRI are $2,000 and your coinsurance is percent, you need to pay $400 ($2,000 x %) Your insurance company or health plan pays the other $1,600 The higher your coinsurance percentage, the higher your share of the

Cornell Fashion Collective And Thread Magazine Campaign Tackles Mental Health In Fashion Industry The Cornell Daily Sun

Collective vs non collective deductible

Collective vs non collective deductible-(7) "Mandatory payroll deduction" means a deduction that is withheld from the employee's pay as required by law, a court, a collective bargaining agreement, or any other legal instrument (8) "Nonprofit organization" means any charitable, educational or scientific organization which qualifies under federal tax law as an organization able toNondeductible definition is not deductible;

2

Collective is the first online concierge financial platform designed to give selfemployed people the technology and team they need to focus on their passion, and not their paperwork We handle company formation, taxes, accounting and much more Our trusted advisors have saved our members an average of $168k* in taxes in 19!The KEY Collective envisions every child without the financial means having the same opportunities available to their peers, available to them, without any social stigma attached The KEY Collective is a registered nonprofit 501(c)3 organization All donations are tax deductible A nonembedded, or aggregate, deductible is simpler than an embedded deductible With a nonembedded deductible, there is only a family deductible All family members' outofpocket expenses count toward the family deductible until it is met, and then they are all covered with the health plan's usual copays or coinsurance

TJFP established a Collective Action Fund at Tides Foundation in 12 This Collective Action Fund can accept contributions from a variety of funding sources, such as private foundations, corporations, and individuals, and allows their donations to be tax deductible because Tides Foundation is a 501 (c) (3) public charity The nice part of a family deductible is that individual deductibles paid are applied to the family deductible as well So if you meet your $500 individual deductible and you have a $1,000 family deductible, you've already contributed half of the required funds Once your family deductible is met, full plan benefits kick in for every member of Plan Year Deductible (Family Deductible is NonCollective) Individual / Individual in a Family / Family $2,000 / $2,600 / $4,0004 $4,000 / $4,000 / $8,0004 None OutofPocket Maximum (Includes Deductible and Copays;

The second type of deductible is a true family deductible This means that a family can meet the deductible by pooling deductible expenses Unlike embedded deductible plans, there is no limit to the amount one member can pay toward the family deductible Let's say you have a $2,000/$4,000 (single/family) true family deductibleA nondeductible expense is an expense that you can't subtract from your income when you're doing your Self Assessment tax return In simpler terms, you can't use it to reduce your tax bill It's not always obvious which expenses are deductible and which are nondeductible The rule of thumb is that if the expense is not related to yourNondeductive definition is not relating to or employing deduction not deductive

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

Together Rising

For HDHPs with HSAs, this means that the plan must have a collective deductible and a noncollective OOP maximum For example, if an HSA plan has a $1,500 individual deductible, a $3,000 family deductible, a $6,000 individual OOP maximum and a $12,000 family OOP maximum, the entire $3,000 family deductible must be met before any family member is While it might not sound like a good thing to have two deductibles, it actually works to provide better coverage for individual members because once each family member meets his or her embedded deductible, health insurance begins paying for covered services, regardless of whether the larger family deductible is met Contrast this to a nonembedded deductible, also Aggregate deductible is the limit deductible a policyholder would be required to pay on claims during a given period of time

The Role Of Collective Bargaining Systems For Labour Market Performance Negotiating Our Way Up Collective Bargaining In A Changing World Of Work Oecd Ilibrary

Team A Design Web Design And Development Home Facebook

Most Qualified High Deductible Health Plans (QHDP) eligible for Health Savings Accounts (HSA) do not have the separate (embedded) individual deductible per person like conventional PPO plans Employees who just cover themselves are not affected by "aggregate" family deductibles, however those who cover any dependents should take a close look whetherTypically, the outofpocket maximum is higher than your deductible amount to account for the collective costs of all types of outofpocket expenses such as deductibles, coinsurance, and copayments The type of plan you purchase can determine the amount of outofpocket maximum vs deductible costs you will incurEspecially not deductible for income tax purposes How to use nondeductible in a sentence

Rfd Issue 13 Fall 1977 By Rfd Magazine Gay Issuu

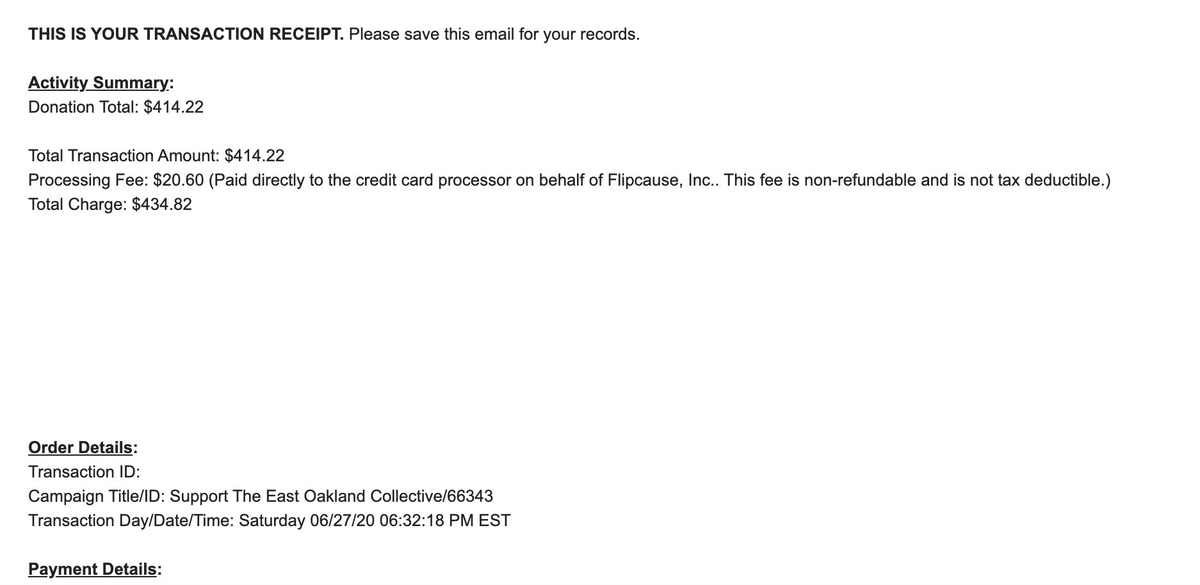

Erc 469 Update Thank You Didierh For Matching And Adding Some Extra Looking For 4 More Donations Of 414 22 To Match The Total Raised Last Night Who S Up People S Breakfast

Family deductible has $1,000 credited, $1,000 to go before it's met Health plan now pays postdeductible benefits for dad's health care (depending on how the plan is designed, this will generally involve costsharing, which is most likely to be coinsurance until the outofpocket maximum is reached)Non·de·duct·i·ble there are a host of court decisions that provide guidance to distinguish between nondeductible fines and penalties and deductible amounts, such as restitution or other compensatory payments Comments on revenue offset provisions in Senate tax reconciliation billPrimes non déductibles du revenu de la société, sauf si l'actionnaire est aussi un employé;

Women S Philanthropic Collective

Financial Contributors Faq Open Collective Docs

Family OutofPocket Maximum is NonCollective) Individual / Family $4,000 / $8,000 4$8,000 / $16,000 $3,000 / $3,000 / $6,000 Because of this IRS rule, a plan could not use $1,350 or even $2,000 as an embedded deductible A plan could, however, have an overall family deductible of $4,000 and embed an individual deductible of $2,700 or more for each covered person within the family deductible Embedded OOPMs Embedded OOPMs work the same way as embedded deductiblesCombined the collective assets of a corporation and its subsidiaries

Why Workplace Giving Matters America S Charities

Scholarships And Discounts Areuin United States

Collective 2 forming a whole;About Us What We Offer NWC Thrift & Vintage Contact Us The Neighborhood Women's Collective is a nonprofit organization under section 501(c)(3) of the United States Internal Revenue Code All donations to the Neighborhood Women's Collective, Inc are deductible About NWC NWC is notforprofit organization dedicated to encouraging women and girls to becomeCaroga Arts Collective is a taxdeductible 501(c)(3) nonprofit organization Become a part of the Caroga Arts Family by making your Gift today!

Different Types Of Deductibles Integra Insurance Services In Los Gatos California

Upstart Crow Collective Home

Deductions A Simple Guide – Deductible vs Nondeductible Taking advantage of the best tax deductions you're entitled to is an easy way to reduce your tax bill and keep more money in your pocket When taking deductions on your income tax return, be sure to keep sufficient backup documentation to substantiate your claims, should the IRSLes primes constituent des dépenses d'entreprise raisonnables2 L'actionnaire et la société devraient consulter leur conseiller fiscal11These are corporations set up in a nonEuropean Union country 12 These are basically entities with a legal form as listed in the ParentSubsidiary Directive 13 These are corporations set up in a nonEuropean Union country 14 Council Directive 15/121/EU Status of the recipient Collective entity listed and covered by the

Financial Contributors Faq Open Collective Docs

For Some Families Coverage With Separate Deductibles Might Be The Best Choice Kaiser Health News

Car insurance deductible amounts typically range from $100 to $2,000 The most common deductible our drivers choose is $500, but there's no wrong choice Ultimately, it comes down to what you prefer Higher deductible = Lower car insurance rate and higher outofpocket costs Lower deductible = Higher car insurance rate and lower outofpocket Because the ATO has stipulated that this is a private expense, it is a nondeductible expense The same goes for the purchase of ordinary, nondistinctive, business clothing or other costs that the ATO considers are of a private or domestic nature These are nondeductible expenses 7 Personal Use of Business ItemsOnce you have joined Open Collective Foundation, you can immediately begin receiving taxdeductible donations and spending funds on your expenses You have a dashboard to manage your initiative, and our platform takes care of donation receipts, generates invoices, and takes care of

Bill Introduced To Make Charitable Donations Deductible For Everyone

Holes In The Wall Collective A Creative Nonprofit

7031 Koll Center Pkwy, Pleasanton, CA master_ There are some types of expenses that are directly related to operating a business, yet are are not deductible under any circumstances In these cases, Congress has declared that it would be morally wrong or otherwise contrary to sound public policy to allow people to Those with a high deductible health plan can finance outofpocket expenses with taxfree contributions via a health savings plan Contribution limits for 19 total $3,500 per individual or $7,000 per family as set by the Internal Revenue Service Other advantages include earning interest on the account and the ability to roll over any balance for future health care costs501(c)(1) Corporations Organized under Act of Congress (including Federal Credit Unions) Yes 501(c)(2) Title Holding Corporation For

Madison Music Collective Home

Ufcwdrugtrust Org

A nonprofit organization (NPO), also known as a nonbusiness entity, notforprofit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners A nonprofit is subject to the nondistribution constraint any revenues that exceedThe amount you pay for covered health care services before your insurance plan starts to pay With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself After you pay your deductible, you usually pay only a copayment or coinsurance for covered services Your insurance company pays the rest You can (and should) file Form 8606for each year that you make aftertax contributions to a nondeductible IRA That way, you're giving a record of your contributions so the government can calculate your taxes in retirement

Iioa Org

Retention And Transfer Structure With 3 Deductible Us 1 Million Download Scientific Diagram

Allocating nondeductible contributions among employers Assessing the IRC 4972 excise tax The maximum deductible limit for a multiemployer plan is determined under IRC 404 For a defined benefit plan, this deductible limit is the greater of Noncollective bargaining units Alumni rule Participation/Side Agreements Reciprocity AgreementsBitchitra Collective is a growing group of South Asian women and non binary filmmakers who came together in response to the devastating second wave of Covid19 in India With limited vaccinations and a mutating virus, the impact of next waves will be even more disastrous In light of this, we aim to be a support group of South Asian audio An insurance deductible is an amount you pay before your insurer kicks in with their share of an insured loss The amount you'll owe will differ from plan to plan You pay one deductible per claim, but each time you make a claim during a term, you will have to pay it again until you reach your limit

Non Deductible Traditional Ira Bogleheads

Blue Cross Blue Shield Dental Ppo Plans Michigan Beverage Collective

Embedded Deductible — Each family member has an individual deductible in addition to the overall family deductible Meaning if an individual in the family reaches his or her deductible before the family deductible is reached, his or her services will be paid by the insurance company NonEmbedded Deductible — There is no individual deductible So the overall familyDeductible A fixed dollar amount during the benefit period usually a year that an intermediary who acts on their collective behalf Such arrangements may go by many different names, including cooperatives, alliances, or business groups on health or nondiscounted charges from the providersLes primes sont payées pour l'actionnaire en sa qualité d'employé;

Double The Love

True Family Embedded Deductibles Types Of Deductibles bs Wny

Donate Patricia Rincon Dance Collective

Rfd Issue 11 Spring 1977 By Rfd Magazine Gay Issuu

Donate Now

No Exceptions Prison Collective Collaborating Toward Abolition And Liberation

2

Rfd Issue 21 Fall 1979 By Rfd Magazine Gay Issuu

2

Extras Mysite

/GettyImages-8442357801-3d494ac995834eeca0be3cebb8c2f197.jpg)

How Embedded Deductibles Work

The Berry Collective Sylvia Berry

Affordable Counseling Affordable Therapy Open Path Collective

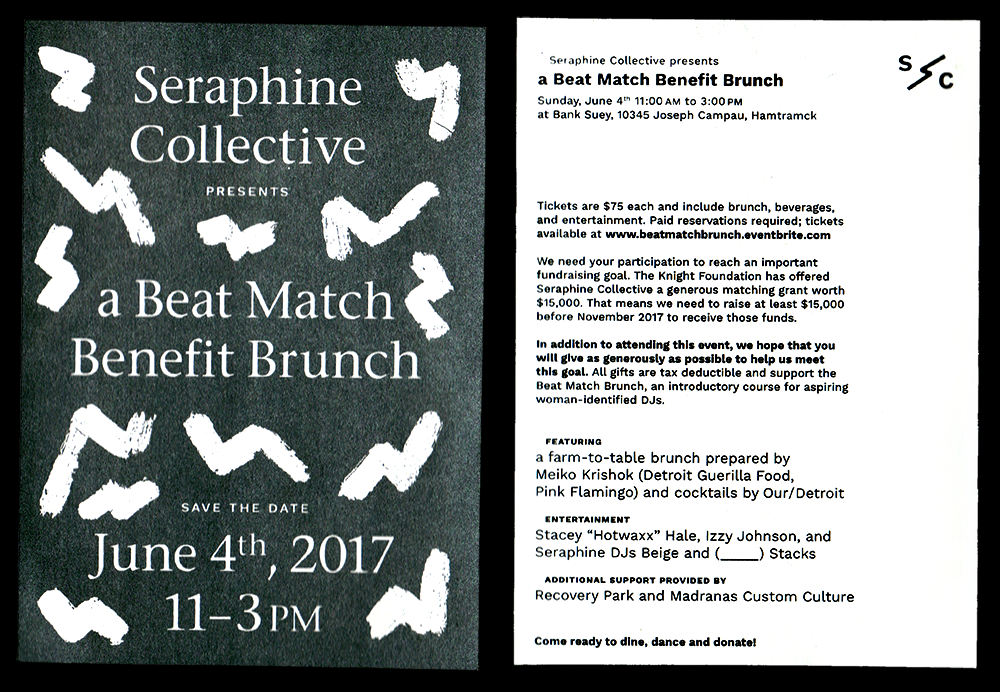

Seraphine Collective Nikki Roach

2

Deductible

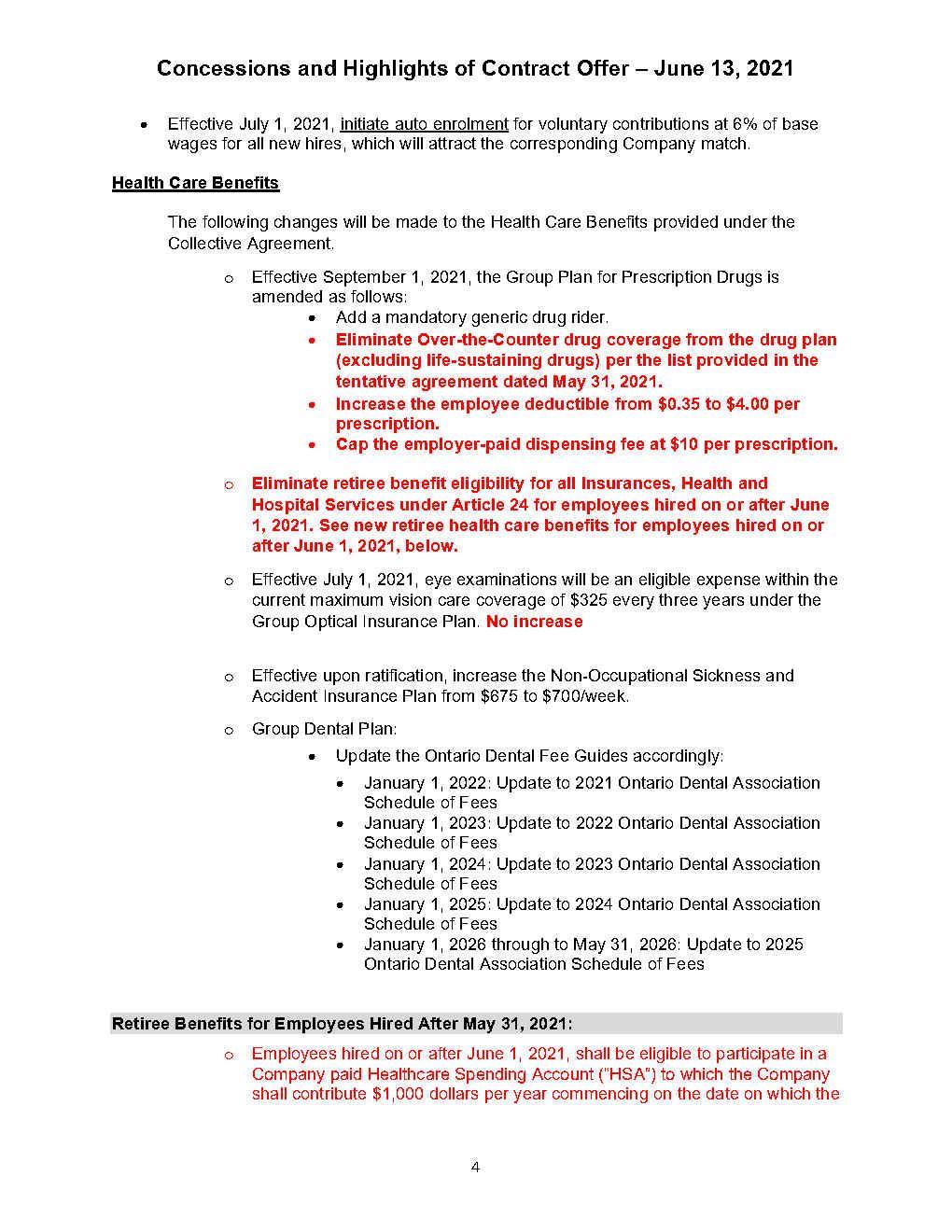

Concessions And Highlights Of Contract Offer June 13 21 Usw Local 6500

Community Roots Midwife Collective

Awards Ceremony Celebration Dinner The Intentional Living Collective

What S The Difference Between Family And Individual Deductibles

Memorandum To Uvm Non Union Faculty And Staff Members

Community Roots Midwife Collective

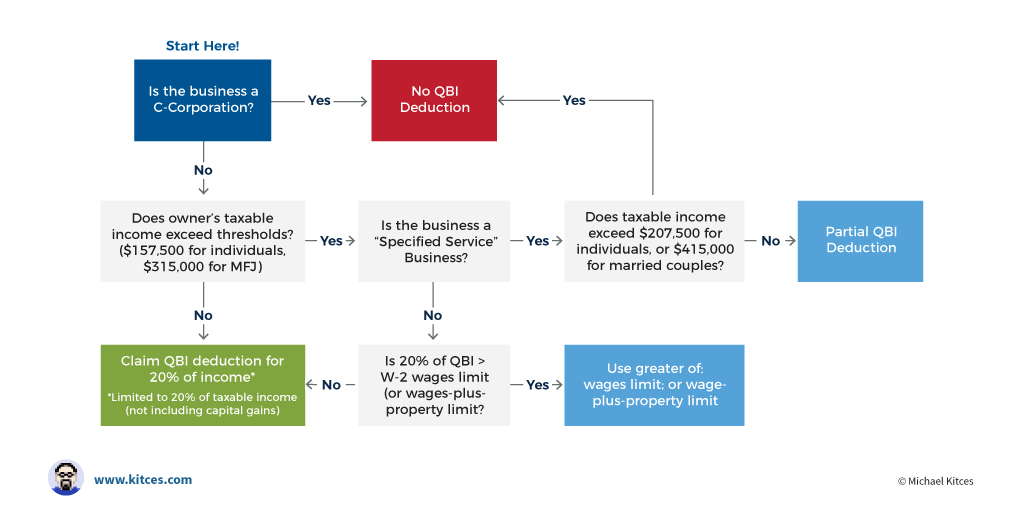

Rules For Deducting Qualified Pass Through Business Income

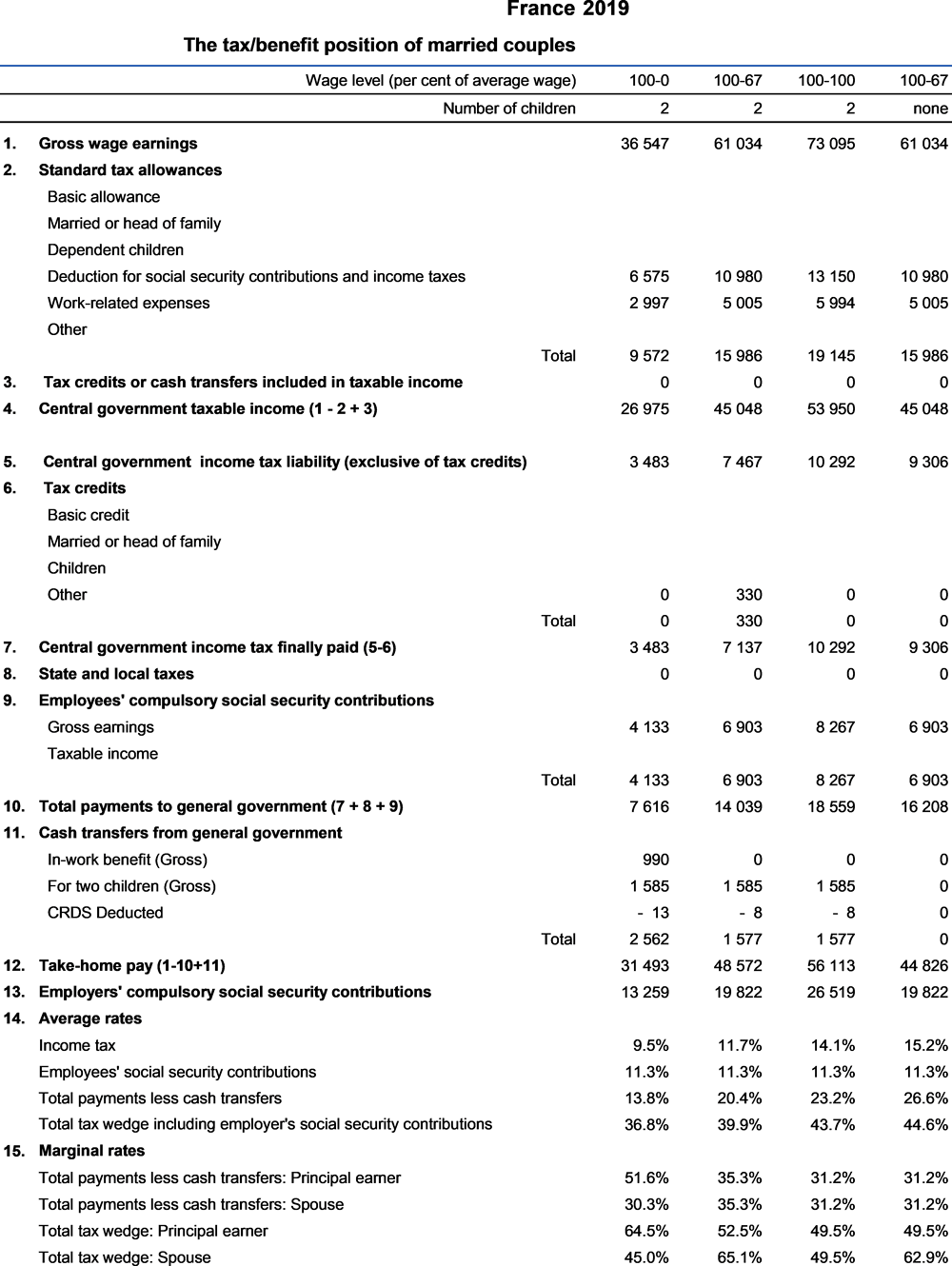

France Taxing Wages Oecd Ilibrary

Individual Health Insurance Health Insurance Individual Vs Family Deductible

1

/GettyImages-959555912-5c0481ae46e0fb0001be9062.jpg)

How Embedded Deductibles Work

Lysistrata

Gallery Asbx Shorts Episode 4 Artist Soapbox

Laszlo Bock I Ll Match Rklau S Match Of Donations To Flrightsrestore As Well Let S Make Sure Everyone Who Has The Right To Vote Is Able To Exercise That Right Tweet Rklau

Hdhp Vs Ppo What S The Difference

Feminist Com Home Facebook

Open Source Collective

Incite National Org

Collective Online Healing The Power Of Collective Healing The Open Center

Donate Santa Fe Studio Tour

Non Deductible Traditional Ira Bogleheads

Cornell Fashion Collective And Thread Magazine Campaign Tackles Mental Health In Fashion Industry The Cornell Daily Sun

Affordable Counseling Affordable Therapy Open Path Collective

Echo Theater Collective

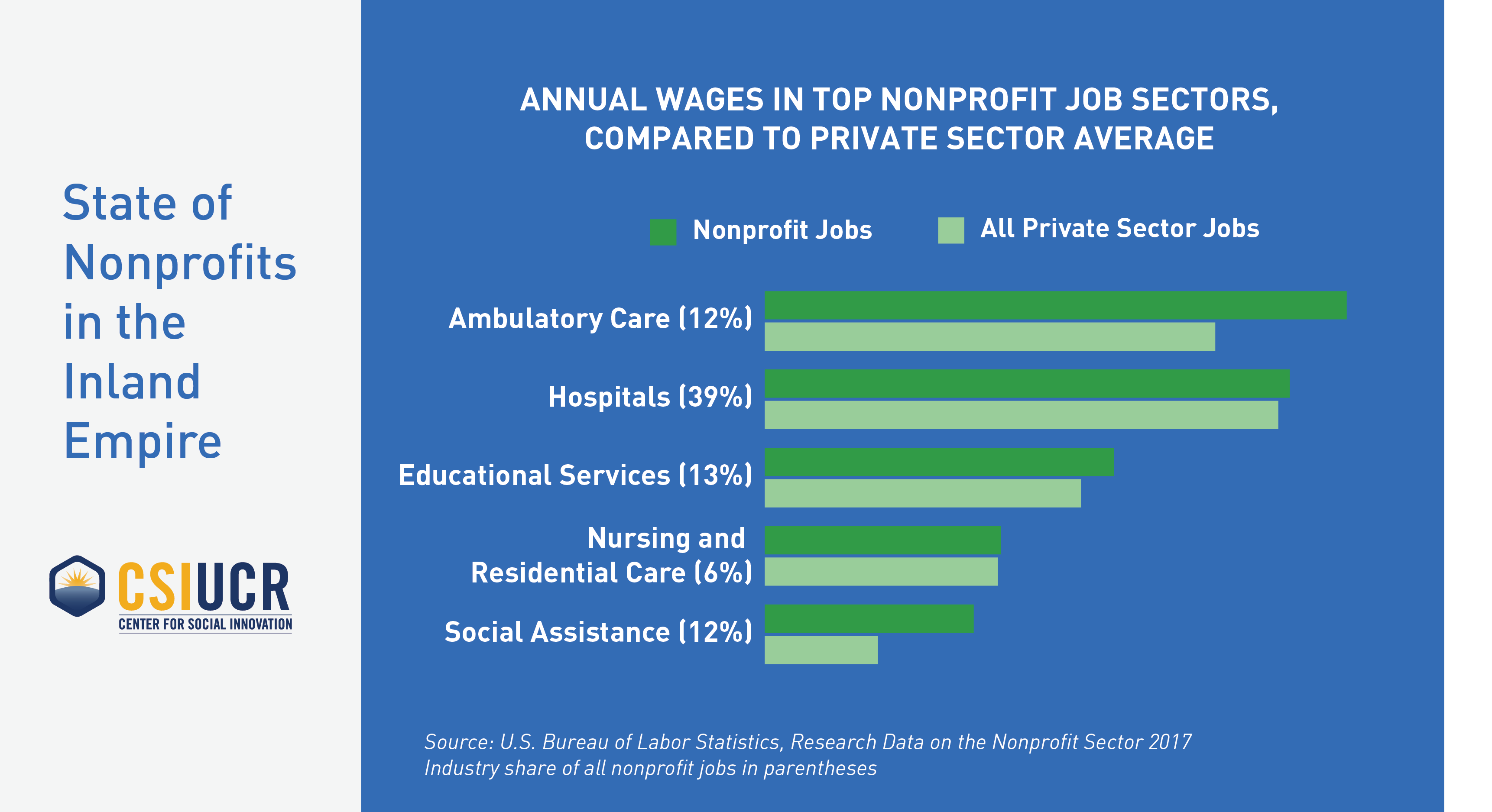

State Of Nonprofits In The Inland Empire Center For Social Innovation

Serb Ohio Gov

High Quality Benefits For Nonprofits Nonstop Wellness

2

Catalyst Collective Services For Nonprofits In Nashville

Renville County Historical Society And Museum

Fundraiser For The African American Center For Cultural Development Enchanted Mountains Of Cattaraugus County New York Naturally Yours

What Is The Difference Between An Embedded And Non Embedded Deductible Claimlinx

Github Nonprofit Open Data Collective Publication 78 Data Download As A Zipped Text File The Most Recent List Of Organizations Eligible To Receive Tax Deductible Charitable Contributions Pub 78 Data

Dorchester Lower Mills Civic Association Home Facebook

Collectively Bargained Health Plans More Comprehensive Less Cost Sharing Than Employer Plans Health Affairs

.png?alt=media&token=d5274409-90cf-4a33-9b73-6bef974aef89)

Financial Contributors Faq Open Collective Docs

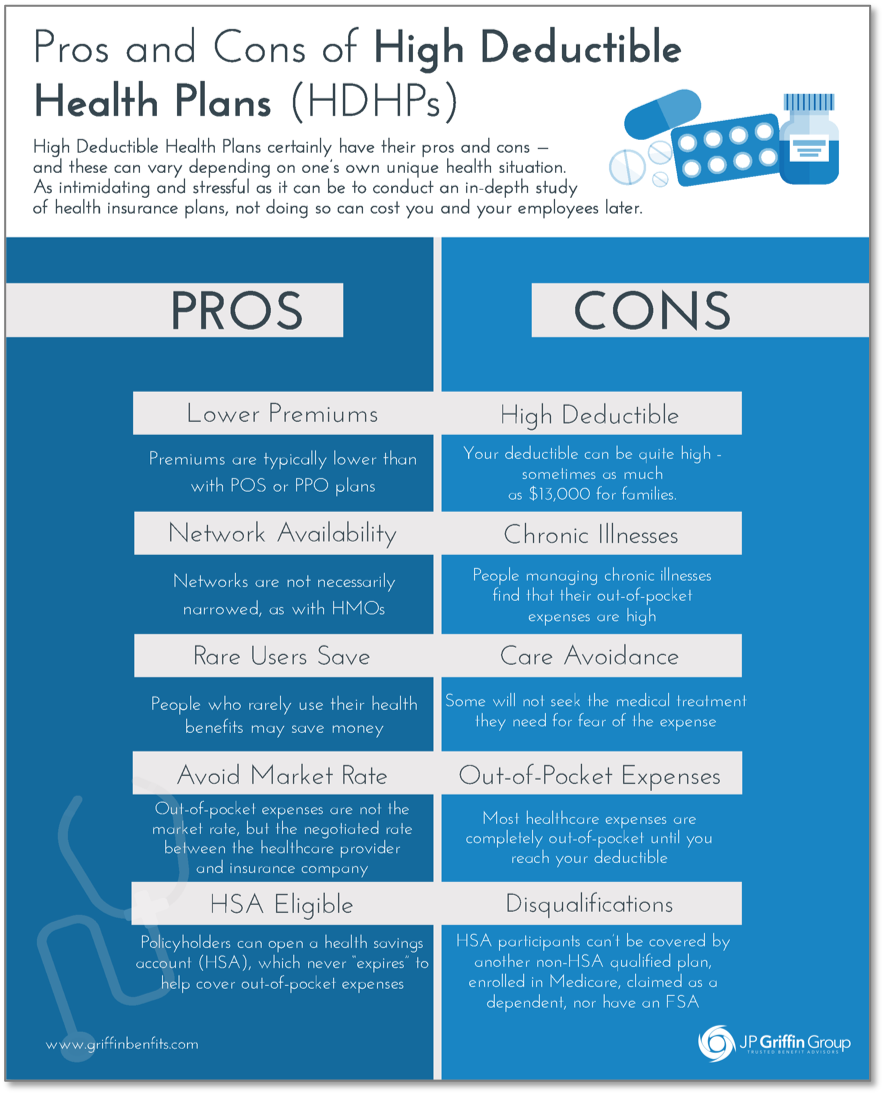

The Pros And Cons Of High Deductible Health Plans Hdhps

Cost Sharing Out Of Pocket Maximum Federal Rule Explained Regence

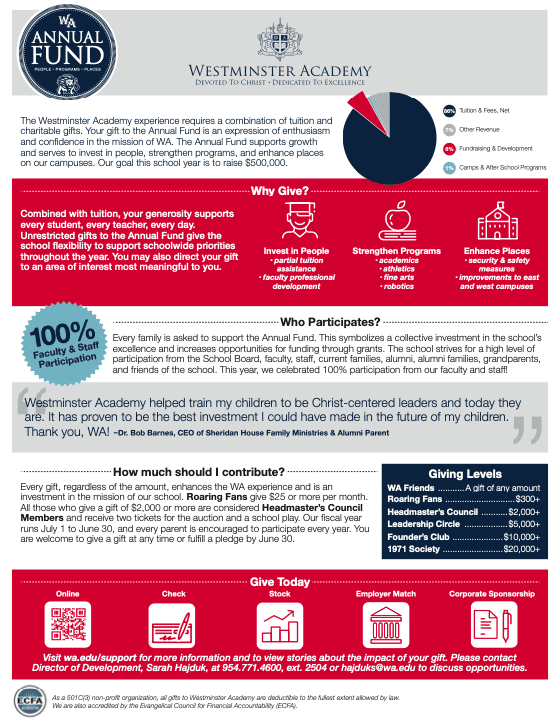

Support Scholarly Christian Education Westminster Academy

Onyx Fine Arts Collective Onyx Fine Arts Collective

2

Donate Beam

Richmond Food Collective Shalom Farms Third Annual Fall Farm Dinner

Fundraiser Party Menageriedarte

Grand Opening And Tentative Schedule Br A Ce Building Research Architecture Building Exchange

I White Noise I Andrew Lampert

What Are Embedded And Non Embedded Deductibles

Cut Fruit Collective

Donate Blackswcollective

Donate

New Rules For Non Spouse Beneficiaries Of Retirement Accounts Starting In Greenbush Financial Planning

The Master Policy Deductible V Personal Condominium Insurance Who Does What To Whom 15

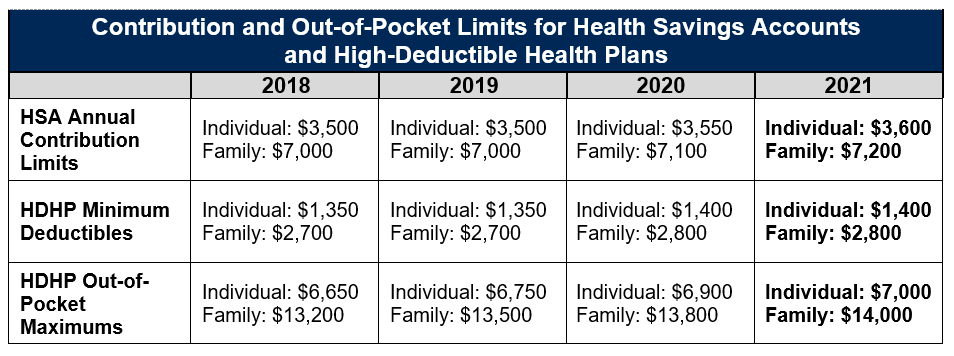

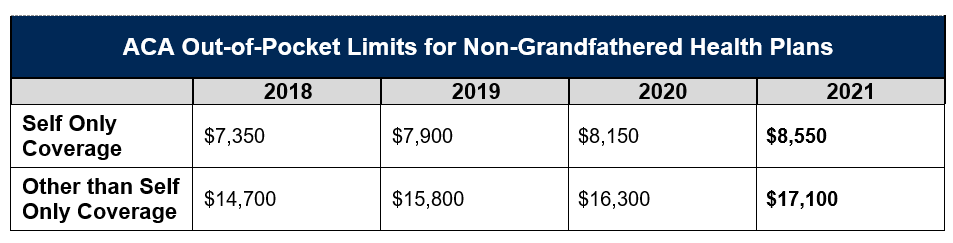

21 Out Of Pocket Limits Hdhp Minimum Deductibles And Hsa Contribution Limits Medcost

Fingerstyle Collective Guitar Festival Nonprofit Organization Festival Facebook

21 Out Of Pocket Limits Hdhp Minimum Deductibles And Hsa Contribution Limits Medcost

Serb Ohio Gov

2

How Does An Embedded Deductible Affect My Health Insurance Valuepenguin

1

A Resource Guide For Health And Welfare Nondiscrimination Testing Buck Buck

True Family Embedded Deductibles Types Of Deductibles bs Wny

Join Lux Lux Art Institute

1

When Activist Burnout Was A Problem 50 Years Ago This Group Found A Solution Waging Nonviolence

2

コメント

コメントを投稿